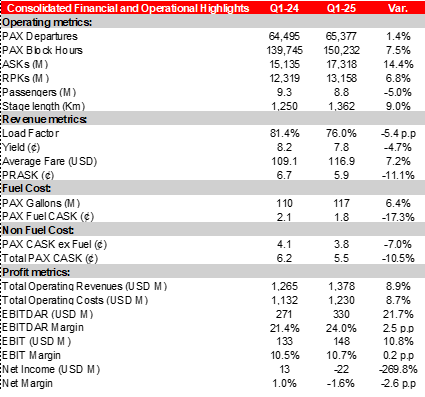

Avianca Announces First Quarter 2025 Financial Results Achieving $330 million in EBITDAR — a 21.7% Increase Year-over-Year

- Avianca achieved the highest first quarter EBITDAR and margin in its history, reaching $330 million in

EBITDAR at a 24.0% margin. - First quarter PAX CASK ex fuel improved to 3.8 cents, demonstrating Avianca´s ongoing commitment to cost discipline.

- The Company´s net leverage decreased sequentially to 3.2x.

- Avianca successfully refinanced a tranche of its Emergence Notes due 2028 and its LifeMiles term loan due 2026, improving its debt maturity profile.

Bogotá, Colombia, 7 de mayo de 2025. Avianca Group International Limited (“AGIL”, “the Company” or “the Group”) today reported its first quarter results. The Company achieved $330 million in EBITDAR for the period, at a margin of 24.0%.

Frederico Pedreira, Avianca’s Chief Executive Officer, stated: “We closed a record first quarter with the highest EBITDAR and margin in our company’s history. We continued optimizing our network, improving profitability in Domestic Colombia and international markets, and driving premium revenue generation with the expansion of our business class service. At the same time, our CASK ex-fuel continued to reflect our cost discipline, and our business units, Avianca Cargo and LifeMiles, achieved strong results. Our performance demonstrates we are delivering operational efficiency, enhanced service, increased revenue, and rigorous cost control, thanks to the commitment and expertise of our 14,000-strong team”.

First Quarter 2025 Highlights

- Avianca’s capacity deployment, measured in Available Seat Kilometers (ASKs) grew to 17,318 million in Q1-25, a 14.4% increase compared to the same period in 2024. The recorded capacity growth was driven by a higher Stage Length (+9.0% year-over-year) and cabin reconfigurations of our Widebody fleet, offset by a meaningfully lower departure growth (+1.6% year-over-year), as the Company aims to drive market balance.

- Avianca launched four new international routes and one new destination, reaching 169 routes to 82 destinations. Furthermore, the Company announced six new routes that will start operations in the second quarter of 2025.

- Total operating revenues in Q1-25 reached $1,378 million, a 8.9% year-over-year increase, supported by the continued optimization of our network and the maturation of initiatives implemented to capture premium passenger revenue, as well as the strong results of LifeMiles and Cargo.

- Passenger and ancillary revenues for the first quarter were $1,030 million, increasing 1.7% relative to Q1- 2024.

- First quarter Passenger CASK ex-fuel improved to 3.8 cents (7.0% year-over-year reduction), demonstrating rigorous cost discipline. In addition, Q1-25 Passenger Fuel CASK was 1.8 cents (17.3% year-over-year reduction), driven by lower fuel prices, cabin reconfiguration of the Boeing 787 fleet, a more fuel-efficient narrowbody aircraft fleet, and the implementation of fuel conservation initiatives. Consequently, Total Passenger CASK was 5.5 cents for Q1-25, a 10.5% decrease relative to the same period in 2024.

- Avianca achieved the highest first quarter EBITDAR and margin in its history, recording $330 million at a 24.0% margin, a 21.7% growth relative to Q1-24, supported by revenue growth initiatives and continuous commitment to cost discipline.

- At the end of the first quarter, Avianca maintained liquidity of $1,190 million, representing 22.1% of last-twelve-month revenues, including cash balance of $990 million, and $200 million in committed liquidity through an undrawn Revolving Credit Facility. Further, Net Debt to last-twelve-month EBITDAR ratio decreased sequentially to 3.2x as of March 31, 2025.

- Avianca Cargo generated $161 million in revenue during Q1-25, representing a 5.3% yearover-year increase, driven by robust market trends. Additionally, Cargo consolidated its position as a market leader in flower transportation from Colombia to the United States, ranking first in both Miami and Los Angeles during the 2025 Valentine's Day season. In total, Cargo transported over 18,000 tons of flowers from Colombia and Ecuador.

- LifeMiles continued to deliver robust results, as Q1-25 Cash EBITDA reached $53 million, a 46.4% year-over-year increase, driven by growing Third-Party Gross Billings and a higher proportion of redemptions in the Avianca network. The Company continued to strengthen brand-loyalty, expanding accrual of miles to all fare types and improving its Elite program and Concierge Club benefits.

- Avianca ended Q1-25 with a passenger operating fleet of 163 aircraft, including 134 Airbus A320 family aircraft, 15 Boeing 787s and 14 Airbus 330s.

- In February 2025, Avianca successfully completed a $1.1 billion exchange offer for the tranche A-1 of its 2028 Senior Secured Notes, and the issuance of $1.0 billion Senior Secured Notes due 2030 to redeem in full the tranche A2 of its 2028 Senior Secured Notes and repay in full the LifeMiles Term Loan B, meaningfully improving the Company’s debt maturity profile.

- The Company implemented the SSR DPNA (Disabled Passenger with Intellectual or Developmental Disability Needing Assistance) code—an IATA-level tool used by airlines that allows passengers with intellectual or developmental disabilities to voluntarily disclose their condition to receive personalized assistance, denoting Avianca’s commitment to offering a more accessible travel experience for everyone.